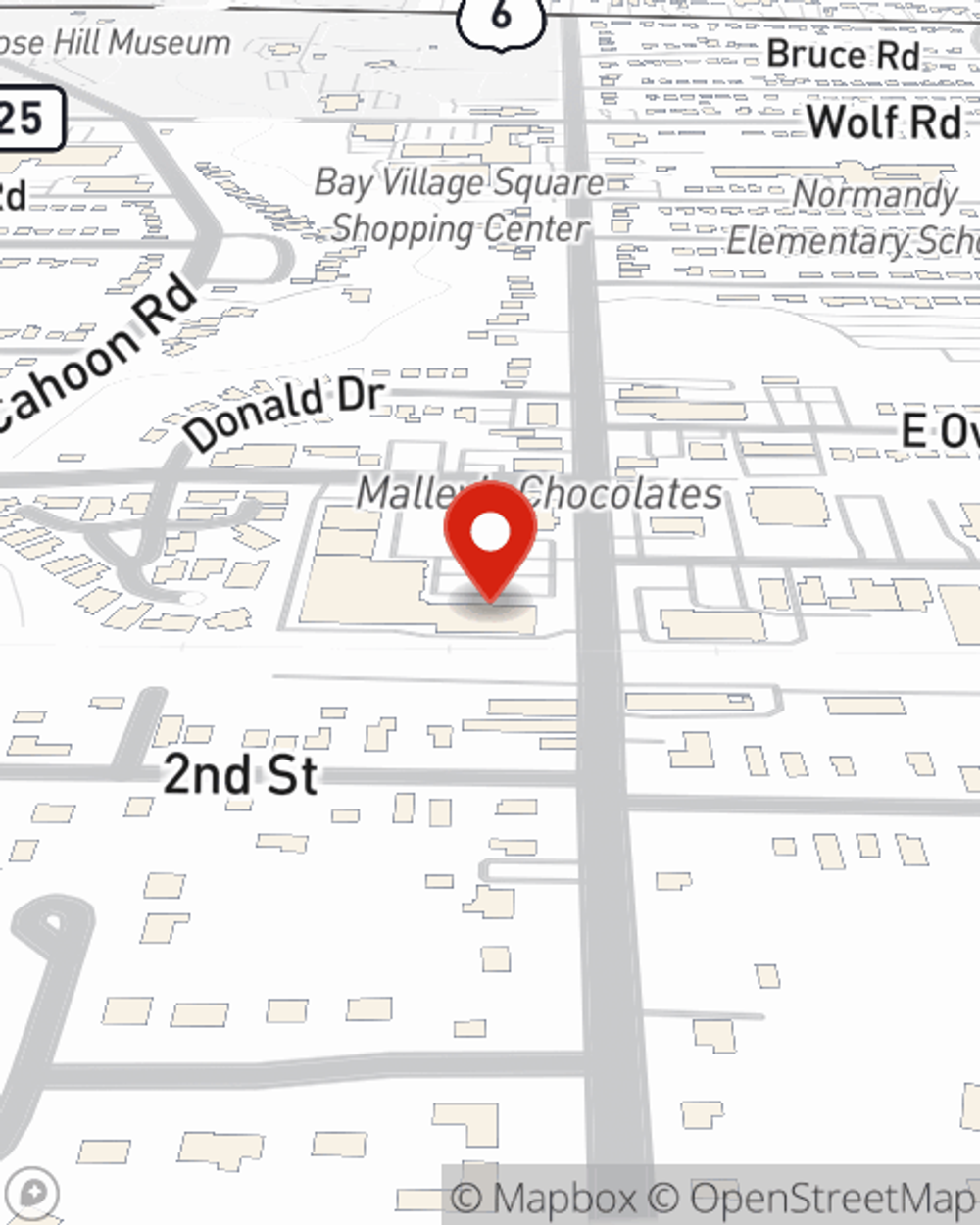

Business Insurance in and around Bay Village

Calling all small business owners of Bay Village!

Helping insure small businesses since 1935

- Bay Village

- Cuyahoga County

- Lorain County

- Medina County

- Erie County

- Summit County

- Lake County

- Huron County

- Geauga County

- Ashland County

- Portage County

- Wayne County

- Cleveland

- Akron

- Lakewood

- Medina

- Mentor

- Willoughby

- Stow

- Brunswick

- Cuyahoga Falls

- Bedford

- Westlake

This Coverage Is Worth It.

Whether you own a an art gallery, a veterinarian, or a cosmetic store, State Farm has small business coverage that can help. That way, amid all the various options and decisions, you can focus on your next steps.

Calling all small business owners of Bay Village!

Helping insure small businesses since 1935

Cover Your Business Assets

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Brad Larson. With an agent like Brad Larson, your coverage can include great options, such as artisan and service contractors, commercial liability umbrella policies and worker’s compensation.

As a small business owner as well, agent Brad Larson understands that there is a lot on your plate. Get in touch with Brad Larson today to talk over your options.

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Brad Larson

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.